Shift Happens. It’s How You Deal That Matters.

For whatever reason, corporate innovation has become synonymous with new business development – but that isn’t the only way to sense for change and encourage the bold and aggressive innovation that today’s world needs from large corporations, idling on the sidelines of cash while the very real game of human happiness sputters.

Taking a step back, most agree with the notion that “Shift Happens” in the world and thus, dealing with it is a necessity to sustained corporate survival, much less profitable growth . The question is then, ‘how’ to best deal with shift.

Shift comes in many forms ranging from new technologies, consumer preferences and business models – In essence, Value Shifts, and corporations must put in place systemic mechanisms to create, detect and respond to these fundamental changes in value which will dictate renewal, aka Innovation – lest they miss the next big thing and join the ranks of the obsolete.

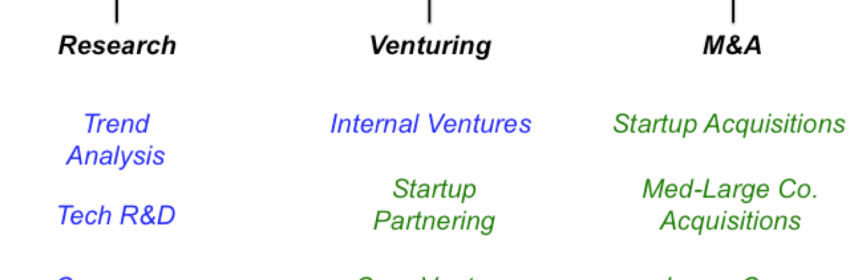

This requires a comprehensive approach to Innovation, which can be separated into nine fundamental ways to listen and respond to Value Shifts, broken out in three main worthy endeavors: Research, Venturing, and yes, M&A.

Research

If a company can sense a Value Shift coming, relatively far, far way (say 2.5, 5, 10, 20+ years, depending on the industry), it should invest in organized research activities. Research can be further broken down in three particular areas: Foresight, Technology R&D and Consumer Insights.

- Foresight: The art of foresight requires assessing various seminal trends in society, government technology and business competition and how they affect one’s given industry. This often requires understanding of complex systems – complexity being the mother of uncertainty. No easy way to do this – reading (good) Science Fiction doesn’t hurt! It’s important to remember that the future cannot be predicted, but it can be shaped (If you don’t, someone else will). If you’re doing foresight right, you should come away with a point of view on the desired future state of your pertinent world – and work towards it.

- Technology R&D: First of all – I hope corporate R&D isn’t dead – it should be alive and well! R&D comes down to understanding one’s core technology S-Curve – deciding when it’s time to double down on the same parameter of performance, but achieving it through a different ‘how’, meaning different set of inventions, or perhaps changing the game by combining different technologies into a new offering (not all of which needs to be ‘invented here’) and/or lastly, deciding it’s time to disrupt oneself, and offer a good-enough version of one’s technology to fight non-consumption …or of course, if you can’t continue to win in the same space, pack-up and move somewhere else.

- Consumer Insights: Talking to customers never hurt anyone – in fact, it’s highly recommended, especially face-to-face, in their physical domain, not the equivalent of a human fish-bowl. The customer, usually a necessity for a healthy business 🙂, can be an invaluable source of inspiration for what comes next, venturing. Startup founders do this, although they don’t often realize it’s what they did before starting their companies. The ones that jumped in the entrepreneurship pool before learning to swim, often go back to pool-side before attempting too many laps – they at least ‘validate’ their ideas with customers before scaling their businesses. Large companies can afford upfront research, with real money, not sweat equity, to best prepare for venturing – Unfortunately, it seems that only consumer brand companies get the importance of consumer insights – but there are visionaries out there, further upstream in the value chain, that understand they too must anticipate the needs of their customer’s customers.

Venturing

If a company can sense a Value Shift relatively near (say today to 2.5 yrs., depending on the industry), it should invest in organized venturing activities. Corporate venturing can be further broken down in three areas: Internal Ventures, Startup Partnering and Corporate Venture Capital.

- Internal Ventures: Internal venturing is simply the act of starting a new business from within an established corporation. This could be a new business within the core market, within logical adjacencies or within non-obvious white spaces. Depending on how related to the core, what needs to be leveraged, etc., a corporation may or may not need to shield the new venturing activity within an internal incubator that abides by different rules (or spinning out new ventures with buy-back clauses). Internal venturing is often what people refer to as corporate innovation – but it’s only a part of the innovation spectrum, albeit crucial to drive an entrepreneurial culture and entice research projects out into the real world, while we’re still young!

- Startup Partnering: Corporations often think they see a new business opportunity before anyone else. Well, maybe before some other slow moving leviathan down the road, but usually not before a swarm of startups is already on it (or at least on Kick Starter). Don’t get me wrong – It’s possible to spot (or risk) things before startups from vantage points that only corporation have, especially if it’s been nurturing a startup-like culture. But when looking to expand into new or undefined markets, it is likely there’s already a startup with at least a leg-up on some crucial part of the puzzle. In those cases, and if it’s still early in the game and there are obvious synergies, then startup partnering option is in order – A corporation can learn to innovate like a startup, but it should be equally adept at innovating with startups, not see them as competitors!

- Corporate Venture Capital: The final venturing option is the back-in-vogue Corporate Venture Capital activity (CVC), which in theory, should make a great complement, not substitute for Internal Venturing and Startup Partnering. CVC should be used for situations where startups of interest have reached a certain maturity of their own – when they mostly need capital, advice and freedom, not necessarily a co-development partner. CVC should be targeting non-strategic areas for the company – yes, non-strategic – startups that could be disruptive to the current business model, that present a completely different way to make money or going after new customers. CVC funds should have investment disciple (or they won’t be invited to the financial VC party), but they must scout the NEXT business for the corporation. Yes, there are other useful purposes for CVC, like fueling the complementary ecosystem needed for a budding internal venture (thus strategic), but the primary mission should be to get ahead of a value shift, not simply supporting what other units have already discovered.

Mergers & Acquisitions

If a company can’t sense a Value Shift to save its life or until it bites them in the ass (say it’s noticing something that it should have noticed yesterday and as far back as 2-3 years), it may still not be too late, and ironically, a good thing if its inept at research and or venturing activity anyways. M&A IS part of the innovation arsenal and it can be broken down in three activities: Startup Acquisitions, Medium to Large Company Acquisitions, and Large Corporate Mergers.

- Startup Acquisitions: When a large company, usually the type sitting on a pile of cash with no clue what to do with, looks at a successful startup and says “We should have thought of that ourselves – they’re going to eat our lunch!” – well, maybe before that actually happens, it should think of buying the startup before it usurps them, or worst, it gets picked up by a competitor that pumps money into the startup to usurp them even faster. If the post M&A integration is done smoothly, startup acquisitions are a great way to renew oneself, and with time, create even greater value for society and investors through some inherent scale advantages (and better execution in the later growth stages that the startup management was unlikely to muster or want to muster, few exceptions aside).

- Medium to Large Company Acquisitions: When a large company, again, usually the conservative, ultra cash rich, awakes one day and decides to move into another (pre-existing) market (where it thinks the grass is greener and it can derive significant synergies with its current assets, capabilities or shrewder business practices), it can still capture value through a relatively significant corporate acquisition – It’s certainly better than assuming that building to compete for premium customers would be less costly than buying an incumbent outright. Hard to sustain this activity, as the only one in the Innovation agenda – but it’s likely a necessity if the company operates in an extremely complex environment where a few Value Shifts will evade the earlier mentioned radars.

- Large Corporate Mergers: Before death, there’s marriage (as romantic as that sounds…It’s birth, freedom, marriage, kids, death, for the record). When a company can admit that’s it has essentially missed a fundamental value shift, but it can bluff that it hasn’t, it should consider a merger with another large competitor before it calls it a day. It’s usually the strategy for the truly out-to-lunch types (and medieval kingdoms), like the newspaper industry, but it can still be a worthwhile, last resort of creating societal and shareholder value – and thus claim the last, albeit dubious, spot on the Innovation tool shed. Filing for bankruptcy is definitely out of the broad Innovation scope I posit in this posting, much less being bailed out by the government.

In Summary

Corporations need a comprehensive set of activities to deal with the inevitable shifts in value that happen in technology, industry and society – this in order to Innovate, that is, renew themselves to provide value in a different, better way.

So if we see Innovation as a renewal process, we must allow the definition to be more encompassing than just new business development, aka Venturing and also include Research, and Merger & Acquisition activities.

The newly created positions of ‘VP of Innovation’ or ‘Chief Innovation Officer’ shouldn’t be awarded to people merely running an internal venturing silo, as it’s often the case. It should be awarded to the person overseeing the entire corporate innovation system from Research, to Venturing to M&A.

Innovation shouldn’t be fragmented into the nine possible discrete activities described above, it should be unified under one umbrella, perhaps employing leaders under the Chief Innovation Officer with responsibility for ‘Value Shift Themes’, being able to coordinate resources in Research, Venturing and M&A (which can maintain their functional management under ‘centers of excellence’). What you don’t want is for the head of R&D to be competing with the head of Venturing to be competing with the head of M&A (for the CEO’s attention) – design it out and focus on delivering value, not agendas!